All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. life insurance for estate planning with brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

There is no payment if the plan runs out before your fatality or you live past the plan term. You might be able to restore a term plan at expiry, however the costs will certainly be recalculated based on your age at the time of renewal.

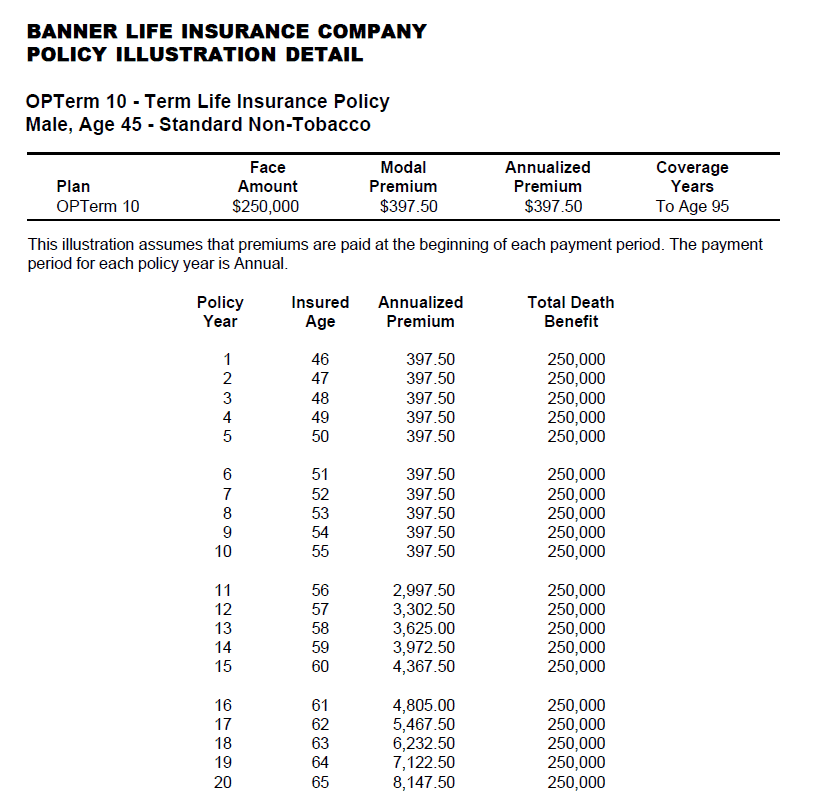

At age 50, the premium would rise to $67 a month. Term Life Insurance Policy Fees three decades old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and females in excellent health and wellness. On the other hand, here's a check out prices for a $100,000 entire life plan (which is a kind of long-term plan, implying it lasts your life time and consists of cash money value).

The decreased threat is one aspect that allows insurance firms to bill reduced premiums. Passion prices, the financials of the insurance firm, and state regulations can also impact premiums. As a whole, companies commonly provide better rates at the "breakpoint" insurance coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the quantity of protection you can get for your costs bucks, term life insurance policy tends to be the least costly life insurance policy.

He buys a 10-year, $500,000 term life insurance policy with a premium of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's recipient $500,000.

If George is diagnosed with a terminal disease throughout the very first plan term, he most likely will not be qualified to renew the plan when it expires. Some policies use guaranteed re-insurability (without evidence of insurability), yet such features come at a greater expense. There are a number of types of term life insurance policy.

A lot of term life insurance has a level premium, and it's the type we've been referring to in many of this article.

Expert Level Term Life Insurance Definition

Term life insurance policy is appealing to youths with children. Parents can acquire substantial coverage for an affordable, and if the insured passes away while the plan holds, the household can count on the fatality benefit to replace lost income. These policies are likewise fit for people with growing family members.

Term life policies are suitable for individuals that want significant insurance coverage at a reduced cost. People that own entire life insurance pay much more in premiums for much less protection yet have the safety of knowing they are protected for life.

The conversion motorcyclist must enable you to transform to any type of irreversible policy the insurance coverage business offers without limitations. The main functions of the rider are keeping the original health ranking of the term plan upon conversion (even if you later have wellness concerns or become uninsurable) and making a decision when and exactly how much of the coverage to transform.

Of training course, total premiums will certainly raise significantly given that whole life insurance policy is much more costly than term life insurance coverage. Medical conditions that establish throughout the term life period can not trigger premiums to be increased.

Term life insurance policy is a reasonably economical method to supply a swelling sum to your dependents if something happens to you. It can be a great option if you are young and healthy and sustain a family. Entire life insurance policy features considerably higher month-to-month costs. It is meant to give insurance coverage for as long as you live.

Specialist Level Term Life Insurance Meaning

It depends on their age. Insurance companies set a maximum age restriction for term life insurance policies. This is usually 80 to 90 years of ages but might be higher or reduced depending upon the business. The premium additionally increases with age, so a person aged 60 or 70 will pay considerably greater than a person decades younger.

Term life is rather comparable to automobile insurance coverage. It's statistically unlikely that you'll require it, and the premiums are cash down the drain if you do not. If the worst happens, your family members will obtain the benefits.

The most prominent type is now 20-year term. A lot of business will certainly not sell term insurance coverage to a candidate for a term that ends past his/her 80th birthday. If a plan is "renewable," that implies it proceeds active for an added term or terms, approximately a defined age, even if the wellness of the insured (or other variables) would cause him or her to be declined if she or he used for a new life insurance policy.

Costs for 5-year sustainable term can be level for 5 years, after that to a brand-new rate reflecting the brand-new age of the guaranteed, and so on every 5 years. Some longer term plans will guarantee that the premium will certainly not boost throughout the term; others don't make that guarantee, allowing the insurance policy firm to raise the price throughout the policy's term.

This suggests that the policy's owner can transform it right into a permanent sort of life insurance policy without additional proof of insurability. In many kinds of term insurance coverage, including homeowners and vehicle insurance coverage, if you have not had a claim under the plan by the time it expires, you obtain no reimbursement of the costs.

Secure Joint Term Life Insurance

Some term life insurance policy customers have actually been dissatisfied at this end result, so some insurance companies have actually developed term life with a "return of costs" attribute. decreasing term life insurance is often used to. The costs for the insurance with this feature are often dramatically more than for plans without it, and they typically call for that you maintain the plan active to its term or else you surrender the return of costs benefit

Degree term life insurance coverage premiums and fatality benefits stay consistent throughout the plan term. Level term life insurance coverage is generally more cost effective as it doesn't develop money value.

Trusted Term Vs Universal Life Insurance

While the names typically are utilized interchangeably, level term coverage has some vital differences: the costs and fatality benefit stay the very same throughout of protection. Level term is a life insurance policy where the life insurance policy premium and survivor benefit continue to be the same throughout of coverage.

Latest Posts

Funeral Plan For Over 30

Senior Solutions Final Expense

Best Funeral Insurance Companies