All Categories

Featured

Table of Contents

This is regardless of whether the guaranteed individual passes away on the day the policy begins or the day prior to the policy finishes. A degree term life insurance policy can suit a large range of scenarios and requirements.

Your life insurance policy plan might additionally develop component of your estate, so might be subject to Estate tax found out more regarding life insurance and tax obligation - 20-year level term life insurance. Let's look at some features of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Critical Disease Cover)

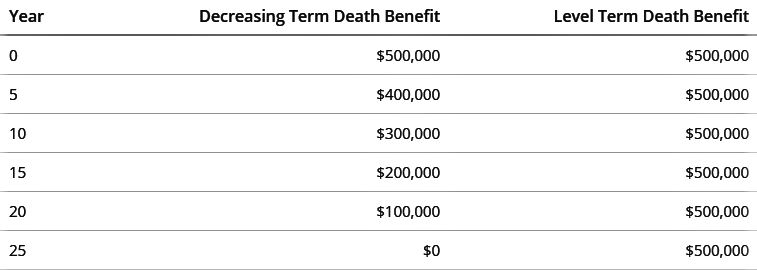

What life insurance coverage could you take into consideration if not level term? Decreasing Life Insurance can aid protect a payment mortgage. The quantity you pay remains the very same, but the degree of cover minimizes about according to the means a payment home mortgage reduces. Decreasing life insurance coverage can assist your enjoyed ones remain in the family members home and avoid any more disturbance if you were to die.

If you select level term life insurance policy, you can spending plan for your premiums since they'll remain the very same throughout your term. Plus, you'll know exactly how much of a survivor benefit your beneficiaries will get if you pass away, as this amount will not transform either. The prices for level term life insurance will certainly depend upon several aspects, like your age, wellness standing, and the insurance provider you select.

When you undergo the application and clinical examination, the life insurance policy company will certainly examine your application. They need to inform you of whether you've been approved shortly after you apply. Upon approval, you can pay your very first premium and sign any relevant paperwork to guarantee you're covered. From there, you'll pay your premiums on a monthly or yearly basis.

What is the Function of Life Insurance Level Term?

You can select a 10, 20, or 30 year term and enjoy the included tranquility of mind you are worthy of. Functioning with an agent can aid you locate a policy that functions best for your demands.

As you seek ways to protect your monetary future, you have actually most likely encountered a large selection of life insurance policy choices. Choosing the best coverage is a large choice. You want to discover something that will help sustain your liked ones or the reasons crucial to you if something happens to you.

What is Term Life Insurance For Spouse? Pros, Cons, and Features

Lots of people lean toward term life insurance policy for its simpleness and cost-effectiveness. Level term insurance policy, nonetheless, is a type of term life insurance policy that has consistent payments and a constant.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. mortgage protection insurance through an agent. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

Level term life insurance is a part of It's called "degree" since your costs and the benefit to be paid to your liked ones continue to be the exact same throughout the contract. You will not see any kind of changes in price or be left questioning its value. Some agreements, such as every year eco-friendly term, may be structured with costs that raise with time as the insured ages.

They're established at the begin and remain the same. Having consistent settlements can help you better strategy and budget plan due to the fact that they'll never change. Repaired death advantage. This is likewise established at the beginning, so you can understand exactly what survivor benefit amount your can anticipate when you die, as long as you're covered and up-to-date on premiums.

You agree to a set costs and fatality advantage for the duration of the term. If you pass away while covered, your death advantage will certainly be paid out to liked ones (as long as your costs are up to date).

What is Increasing Term Life Insurance? Key Points to Consider?

You may have the choice to for one more term or, more likely, restore it year to year. If your contract has an ensured renewability stipulation, you may not require to have a new medical examination to maintain your insurance coverage going. Your premiums are likely to boost because they'll be based on your age at revival time.

With this alternative, you can that will certainly last the remainder of your life. In this case, once again, you may not require to have any kind of new medical examinations, however costs likely will increase due to your age and brand-new insurance coverage (Increasing term life insurance). Different business use numerous alternatives for conversion, make certain to recognize your options prior to taking this step

Many term life insurance is level term for the duration of the agreement period, however not all. With decreasing term life insurance policy, your death benefit goes down over time (this kind is often taken out to particularly cover a long-term debt you're paying off).

And if you're set up for eco-friendly term life, after that your premium likely will increase yearly. If you're checking out term life insurance and want to ensure uncomplicated and predictable economic security for your family members, degree term may be something to think about. However, as with any kind of sort of protection, it may have some restrictions that do not fulfill your demands.

How Does Term Life Insurance For Spouse Benefit Families?

Usually, term life insurance policy is more budget friendly than irreversible coverage, so it's a cost-effective way to safeguard monetary protection. At the end of your agreement's term, you have numerous choices to proceed or relocate on from protection, usually without requiring a medical test.

Similar to various other sort of term life insurance policy, when the contract finishes, you'll likely pay greater premiums for coverage because it will recalculate at your existing age and wellness. Dealt with coverage. Level term offers predictability. If your monetary scenario modifications, you may not have the essential coverage and might have to buy added insurance policy.

That doesn't mean it's a fit for every person. As you're buying life insurance policy, below are a couple of key factors to consider: Budget plan. Among the advantages of level term insurance coverage is you understand the price and the fatality advantage upfront, making it much easier to without bothering with increases gradually

Age and health. Typically, with life insurance coverage, the healthier and younger you are, the more affordable the insurance coverage. If you're young and healthy and balanced, it might be an attractive choice to secure reduced premiums currently. Financial responsibility. Your dependents and monetary obligation play a function in determining your insurance coverage. If you have a young household, for circumstances, level term can aid supply financial backing during critical years without paying for coverage much longer than needed.

Latest Posts

Funeral Plan For Over 30

Senior Solutions Final Expense

Best Funeral Insurance Companies