All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. mortgage protection insurance through an agent. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

That typically makes them a much more affordable option for life insurance policy protection. Many people get life insurance coverage to assist economically secure their enjoyed ones in situation of their unexpected death.

Or you may have the alternative to convert your existing term coverage right into a permanent plan that lasts the remainder of your life. Different life insurance policy policies have possible advantages and downsides, so it's vital to understand each before you determine to purchase a policy.

As long as you pay the premium, your recipients will get the survivor benefit if you pass away while covered. That said, it is very important to note that the majority of policies are contestable for two years which suggests protection could be retracted on fatality, needs to a misstatement be discovered in the app. Plans that are not contestable commonly have actually a graded fatality advantage.

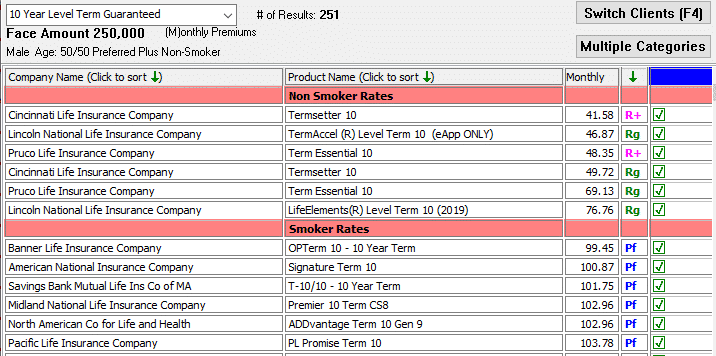

Costs are normally lower than entire life policies. You're not locked right into an agreement for the rest of your life.

And you can't cash out your plan during its term, so you won't get any type of economic take advantage of your past protection. As with other types of life insurance, the price of a degree term plan relies on your age, protection demands, work, way of life and health and wellness. Usually, you'll discover more inexpensive insurance coverage if you're more youthful, healthier and much less dangerous to guarantee.

Effective Term Life Insurance For Couples

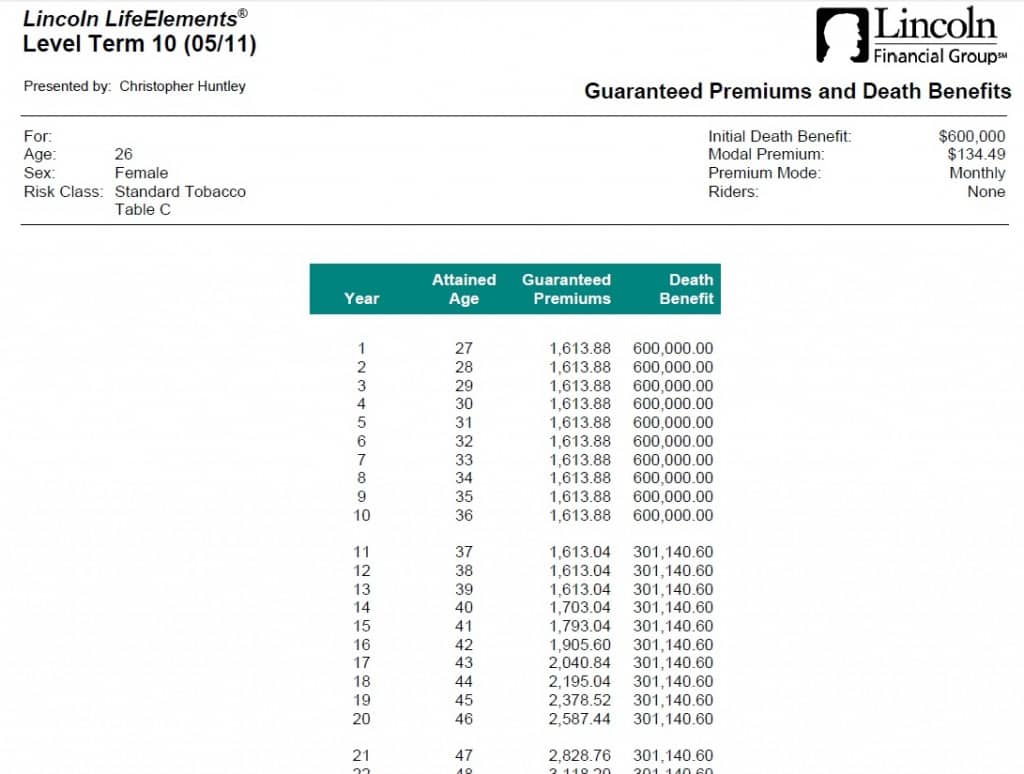

Considering that level term premiums remain the exact same for the period of protection, you'll recognize specifically just how much you'll pay each time. Level term insurance coverage also has some flexibility, allowing you to tailor your policy with extra functions.

You may have to satisfy specific problems and qualifications for your insurer to pass this motorcyclist. There also might be an age or time restriction on the insurance coverage.

The fatality benefit is usually smaller sized, and insurance coverage typically lasts until your kid turns 18 or 25. This rider may be an extra cost-efficient way to assist guarantee your youngsters are covered as cyclists can commonly cover multiple dependents simultaneously. Once your child ages out of this coverage, it might be feasible to transform the rider into a new policy.

When contrasting term versus irreversible life insurance policy. guaranteed issue term life insurance, it is very important to bear in mind there are a few various kinds. The most usual kind of permanent life insurance policy is whole life insurance policy, yet it has some essential distinctions contrasted to level term coverage. Here's a standard introduction of what to think about when comparing term vs.

Whole life insurance policy lasts for life, while term protection lasts for a specific period. The premiums for term life insurance coverage are normally lower than entire life coverage. With both, the premiums remain the same for the period of the policy. Entire life insurance policy has a cash worth part, where a part of the costs might grow tax-deferred for future requirements.

One of the major features of degree term protection is that your costs and your death advantage don't transform. You may have coverage that starts with a fatality advantage of $10,000, which might cover a home mortgage, and then each year, the death benefit will certainly lower by a set quantity or percent.

Due to this, it's frequently a more cost effective kind of degree term insurance coverage. You may have life insurance policy via your employer, however it may not suffice life insurance policy for your requirements. The first action when purchasing a policy is determining exactly how much life insurance policy you need. Take into consideration variables such as: Age Family dimension and ages Employment condition Income Debt Way of life Expected last costs A life insurance policy calculator can aid figure out how much you need to start.

After determining on a plan, finish the application. If you're accepted, authorize the documents and pay your very first costs.

Preferred Level Premium Term Life Insurance Policies

Think about scheduling time each year to examine your plan. You may intend to update your beneficiary information if you have actually had any considerable life modifications, such as a marriage, birth or separation. Life insurance policy can sometimes feel complex. But you do not need to go it alone. As you explore your choices, think about discussing your needs, wants and interests in a monetary professional.

No, degree term life insurance policy does not have cash money worth. Some life insurance coverage policies have a financial investment attribute that enables you to build cash value with time. A part of your premium payments is reserved and can earn passion over time, which grows tax-deferred during the life of your insurance coverage.

You have some options if you still want some life insurance coverage. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might want to acquire a brand-new 10-year degree term life insurance policy.

Tailored A Term Life Insurance Policy Matures

You may have the ability to transform your term insurance coverage into a whole life plan that will certainly last for the rest of your life. Numerous kinds of degree term plans are exchangeable. That implies, at the end of your insurance coverage, you can transform some or all of your plan to whole life coverage.

Level term life insurance is a plan that lasts a set term typically in between 10 and 30 years and features a degree fatality benefit and level costs that remain the same for the entire time the plan is in effect. This means you'll recognize precisely just how much your payments are and when you'll have to make them, allowing you to budget plan appropriately.

Degree term can be a wonderful option if you're seeking to get life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance policy Barometer Research, 30% of all adults in the U.S. need life insurance policy and do not have any type of kind of plan. Degree term life is foreseeable and affordable, that makes it one of the most popular sorts of life insurance coverage.

Latest Posts

Funeral Plan For Over 30

Senior Solutions Final Expense

Best Funeral Insurance Companies