All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. universal life insurance for long-term growth with brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

There is no payment if the plan expires prior to your death or you live beyond the policy term. You may be able to restore a term policy at expiry, however the premiums will certainly be recalculated based on your age at the time of renewal.

At age 50, the costs would climb to $67 a month. Term Life Insurance coverage Fees thirty years old $18 $15 40 years of ages $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in exceptional health and wellness. On the other hand, right here's a take a look at prices for a $100,000 whole life plan (which is a sort of permanent plan, suggesting it lasts your life time and consists of cash money worth).

The reduced danger is one aspect that enables insurance companies to bill reduced costs. Rates of interest, the financials of the insurer, and state regulations can also impact premiums. As a whole, firms commonly provide better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you think about the amount of insurance coverage you can obtain for your premium dollars, term life insurance policy tends to be the least costly life insurance policy.

He purchases a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George dies within the 10-year term, the plan will pay George's recipient $500,000.

If George is diagnosed with a terminal ailment throughout the very first policy term, he most likely will not be eligible to restore the plan when it runs out. Some policies provide guaranteed re-insurability (without proof of insurability), but such attributes come at a greater expense. There are numerous sorts of term life insurance policy.

Usually, a lot of companies provide terms ranging from 10 to three decades, although a few offer 35- and 40-year terms. Level-premium insurance has a fixed monthly payment for the life of the policy. Many term life insurance coverage has a level premium, and it's the kind we have actually been referring to in a lot of this write-up.

Specialist Short Term Life Insurance

Term life insurance policy is appealing to young people with youngsters. Parents can get significant insurance coverage for an affordable, and if the insured passes away while the plan holds, the family can rely on the survivor benefit to replace lost revenue. These plans are likewise well-suited for individuals with growing households.

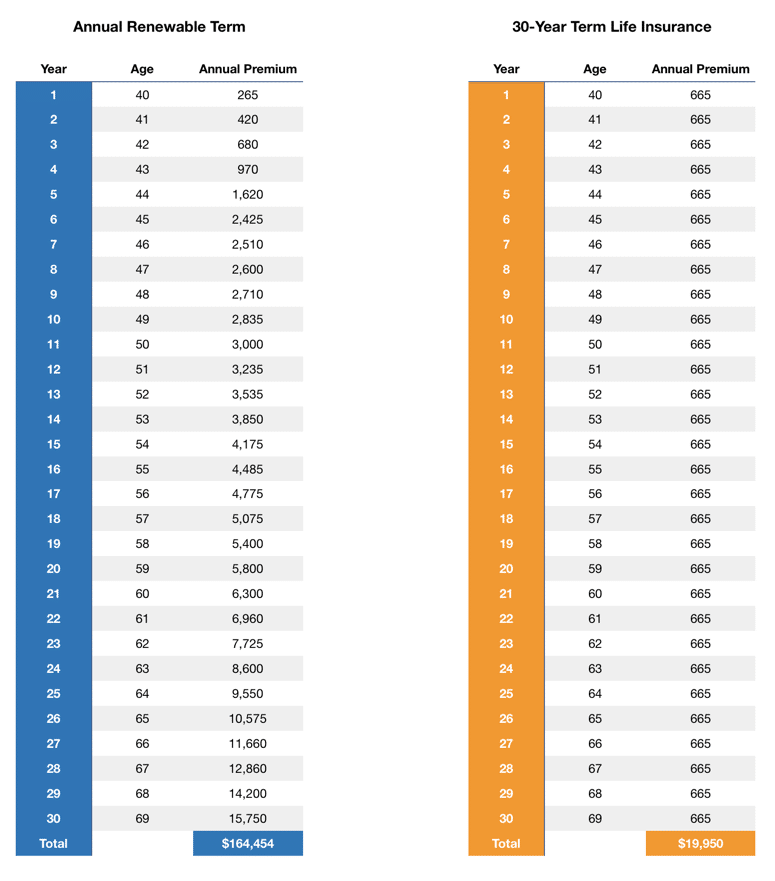

Term life policies are optimal for individuals that want significant protection at a low price. People who own whole life insurance coverage pay a lot more in premiums for much less insurance coverage however have the safety and security of understanding they are safeguarded for life.

The conversion biker should allow you to transform to any kind of permanent plan the insurance firm uses without limitations. The main attributes of the biker are preserving the original health score of the term plan upon conversion (even if you later on have health and wellness problems or come to be uninsurable) and choosing when and just how much of the protection to transform.

Of training course, total costs will certainly boost significantly considering that whole life insurance policy is much more pricey than term life insurance coverage. The benefit is the assured approval without a medical examination. Medical problems that create during the term life period can not cause premiums to be enhanced. The business might need restricted or complete underwriting if you desire to add additional motorcyclists to the new plan, such as a lasting treatment rider.

Whole life insurance comes with considerably greater monthly premiums. It is implied to offer protection for as long as you live.

What Is Level Term Life Insurance

It depends upon their age. Insurance coverage business established an optimum age limitation for term life insurance policy policies. This is generally 80 to 90 years of ages but might be higher or reduced depending on the firm. The costs also increases with age, so an individual aged 60 or 70 will pay significantly more than someone decades more youthful.

Term life is rather similar to car insurance. It's statistically unlikely that you'll require it, and the costs are cash down the tubes if you don't. But if the worst occurs, your family members will get the advantages.

The most prominent kind is now 20-year term. The majority of companies will not sell term insurance policy to an applicant for a term that finishes previous his or her 80th birthday. If a plan is "renewable," that suggests it proceeds active for an added term or terms, as much as a specified age, also if the health of the insured (or other variables) would cause him or her to be turned down if he or she requested a new life insurance plan.

Costs for 5-year eco-friendly term can be degree for 5 years, then to a brand-new rate showing the new age of the insured, and so on every five years. Some longer term plans will guarantee that the premium will certainly not increase throughout the term; others do not make that assurance, making it possible for the insurance policy firm to increase the price during the policy's term.

This suggests that the plan's proprietor deserves to alter it into an irreversible type of life insurance policy without extra proof of insurability. In most kinds of term insurance coverage, including house owners and auto insurance policy, if you haven't had a claim under the plan by the time it runs out, you obtain no refund of the costs.

Flexible A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Some term life insurance consumers have been unhappy at this end result, so some insurers have created term life with a "return of premium" function. term vs universal life insurance. The premiums for the insurance with this feature are frequently significantly more than for plans without it, and they usually call for that you keep the plan effective to its term otherwise you forfeit the return of costs benefit

Level term life insurance policy costs and death advantages stay consistent throughout the plan term. Level term life insurance policy is commonly much more affordable as it doesn't develop cash money worth.

Premium A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

While the names typically are used mutually, degree term insurance coverage has some crucial distinctions: the costs and survivor benefit remain the same for the period of protection. Degree term is a life insurance plan where the life insurance coverage costs and death advantage continue to be the very same for the duration of coverage.

Latest Posts

Funeral Plan For Over 30

Senior Solutions Final Expense

Best Funeral Insurance Companies