All Categories

Featured

Table of Contents

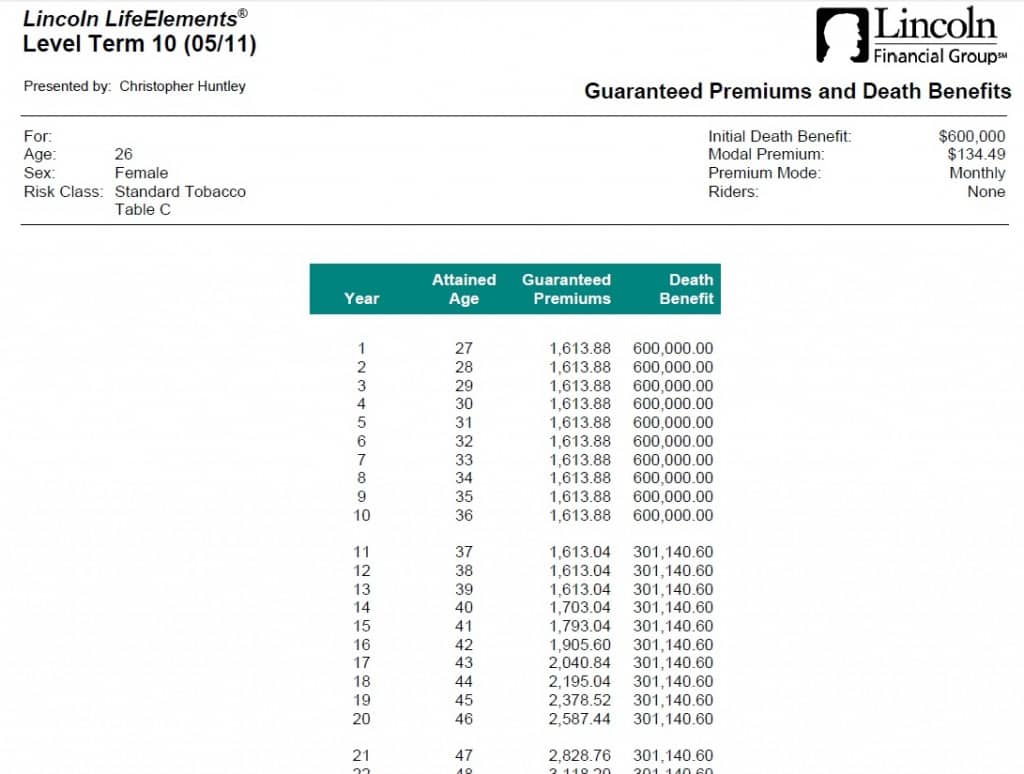

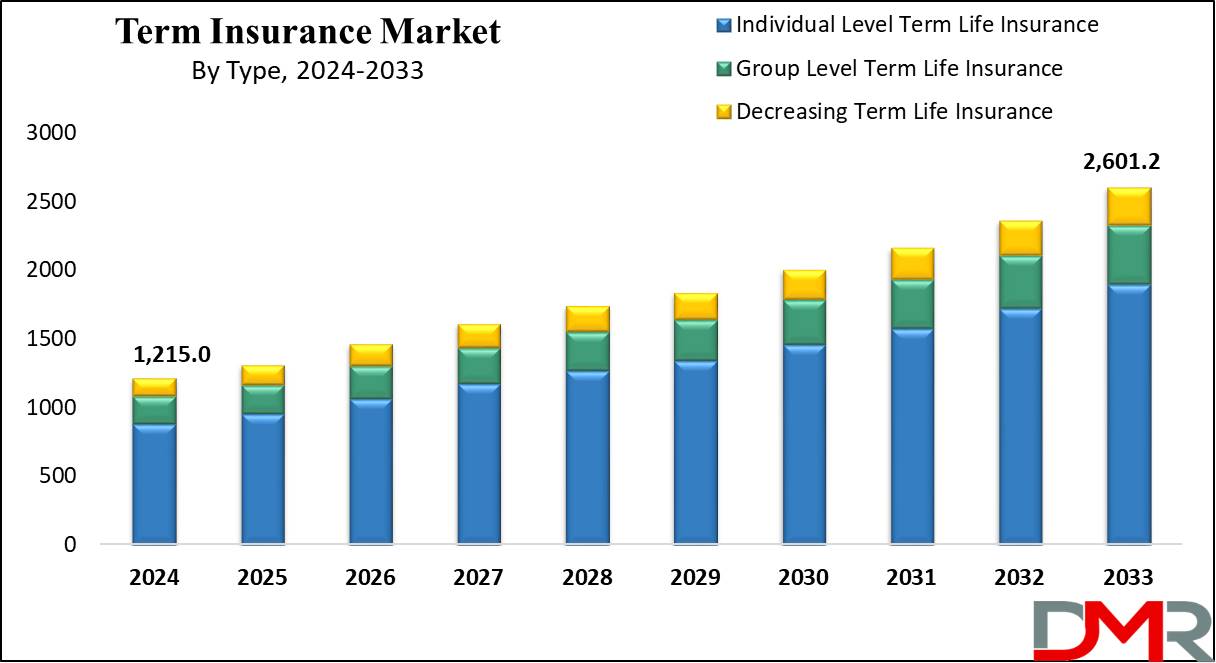

A degree term life insurance policy plan can offer you assurance that individuals that depend upon you will have a survivor benefit throughout the years that you are preparing to support them. It's a method to aid look after them in the future, today. A level term life insurance policy (often called degree costs term life insurance policy) plan supplies coverage for an established number of years (e.g., 10 or two decades) while maintaining the costs settlements the very same throughout of the plan.

With degree term insurance, the cost of the insurance will remain the same (or possibly lower if rewards are paid) over the regard to your plan, normally 10 or two decades. Unlike long-term life insurance, which never ends as long as you pay costs, a level term life insurance policy policy will certainly end at some factor in the future, typically at the end of the duration of your degree term.

What is 30-year Level Term Life Insurance? A Simple Explanation?

Due to this, lots of individuals utilize irreversible insurance policy as a secure financial preparation device that can serve numerous needs. You may be able to convert some, or all, of your term insurance throughout a set duration, usually the first one decade of your plan, without needing to re-qualify for insurance coverage even if your health has altered.

As it does, you might wish to include in your insurance policy protection in the future. When you first obtain insurance policy, you might have little savings and a large mortgage. At some point, your cost savings will expand and your home loan will certainly shrink. As this takes place, you might intend to eventually lower your survivor benefit or consider transforming your term insurance coverage to an irreversible plan.

As long as you pay your costs, you can relax easy knowing that your loved ones will certainly get a survivor benefit if you pass away during the term. Many term policies permit you the capability to convert to irreversible insurance without needing to take one more wellness examination. This can permit you to benefit from the fringe benefits of an irreversible policy.

Degree term life insurance coverage is among the most convenient paths into life insurance policy, we'll discuss the benefits and drawbacks to make sure that you can select a strategy to fit your demands. Level term life insurance coverage is one of the most usual and fundamental form of term life. When you're trying to find short-lived life insurance plans, level term life insurance policy is one path that you can go.

You'll load out an application that contains basic individual details such as your name, age, and so on as well as a more thorough survey regarding your medical history.

The short solution is no. A degree term life insurance policy policy doesn't develop cash money value. If you're wanting to have a policy that you're able to take out or obtain from, you might explore permanent life insurance policy. Entire life insurance coverage policies, as an example, let you have the convenience of fatality benefits and can accumulate money worth in time, meaning you'll have extra control over your benefits while you live.

What is 10-year Level Term Life Insurance? Your Guide to the Basics?

Riders are optional provisions included to your policy that can offer you added advantages and protections. Anything can occur over the course of your life insurance term, and you want to be all set for anything.

There are instances where these advantages are developed into your policy, however they can additionally be offered as a different addition that requires additional payment.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - instant life insurance quotes from an agent. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

Latest Posts

Funeral Plan For Over 30

Senior Solutions Final Expense

Best Funeral Insurance Companies